The Parisian Arcades

The “Four Cs”: Commodities, Currency (Money), Capital, and Corporations

POSITIVE DEFINITIONS

First we can state briefly what these objects concretely are, so that we can then spell out exactly what they are not.

Commodity — A commodity is any product that is produced for sale on the market, i.e. for the sake of exchange. Like any other product (non-commodities included), it has a certain utility, or “use-value.” Products, regardless of their salability, tend to be useful in some way or another, to satisfy a certain need. Use-values are of a qualitative nature. That is to say, they are useful because they possess certain utile qualities.

Unlike other products, however, commodities also possess a certain value, or “exchange-value.” As soon as a product becomes available for exchange on the market, it is thereby converted into a commodity. Exchange-values are of a quantitative nature. That is to say, they are valuable because they possess a certain quantity of value.

(It must be noted, however, that if a commodity loses its use-value, i.e. becomes broken or useless, it simultaneously loses any exchange-value it might have had).

How is this quantity of exchange-value determined? What is the basis for the following equation: 20 yards of linen = 1 coat? In terms of their material qualities, the two are totally incommensurable. A coat may be made of linen, but a single coat does not require 20 yards of linen to produce. Nevertheless, their quantitative equality presupposes an underlying qualitative identity of substance. The question thus becomes: What exactly is this substance?

The substantial basis for the equality of two dissimilar items or use-values is the amount of labor-power expended upon them, measured in homogeneous units of time (days, hours, minutes, etc.). This alone determines the magnitude of value that a commodity possesses.

Commodities are not unique to capitalism. They preexist the crystallization of the capitalist social formation. However, in precapitalist societies, the majority of goods that are produced are not commodities. In other words, most products are intended for immediate use or consumption, either by their producer himself or his next-of-kin. Society’s general mode of production is only properly called “capitalist” when the majority of its products are commodities.

One final point about the commodity-form should be made before passing on to money. This concerns the extent to which one’s labor (or more specifically, one’s labor-time) can itself be sold as a commodity on the market. An employer purchases a certain duration of a person’s labor-time in exchange for the services rendered or products produced. In return, the employee is typically compensated by hourly wages or an annual salary.

Though wage-labor existed in the margins of precapitalist society, the reproduction of the capitalist mode of production requires that there exists a large displaced population of persons whose only commodity available for sale is their labor. Thus, under capitalism, wage-labor or salaries becomes generalized as the societal norm.

Currency/Money — Money is a certain commodity that is set aside to serve as a universal measurement of value. It is the universal equivalent of qualitatively dissimilar commodities. Money therefore serves as a quantitative medium of exchange.

In another sense, money (as such) is the circulation of commodities. That is to say, it provides the means by which the exact quantity of one commodity is traded for an exact equivalent quantity of money, which is then used to purchase a given quantity of another. Money acts as an intermediary in place of direct barter.

This operation can be illustrated by a simple formula, using these symbols:

C = Commodity.

M = Money.

C → M → C.

One commodity is sold for its value in money, which is then used to purchase an equivalent value in another commodity. This allows for a more equitable exchange of value between commodities than took place in simple barter, which tended to involve uneven transactions.

Capital — Capital is self-valorizing value. In other words, it is value that becomes more value, or money (which is but an expression of value) that magically transforms itself into more money. The principle of capitalization is that you start the day with a certain amount of money, and by the end of the day you have more money.

As Marx put it, this process is almost “theological.” In capital, value becomes at once the subject and object of its own activity, ceaselessly augmenting its own magnitude. The analogy Marx uses is the differentiation of God the Father from God the Son in the triune theology of traditional Christianity; they are both made from the same substance, and are equally old, yet one begets the other.

The ultimate expression of capital in all its forms is the following:

M → Mº.

(º = “prime.” Money “prime” signifies the increment of value over and above the amount of value originally advanced. Once thrown back into the circuit of production and circulation, however, this augmented money or value obtained as a result of capitalization becomes the starting value of the new formula).

Species of Capital

1. Interest-bearing (usurers’) capital — M → Mº. This is the basic formula of money lending or usury.

A certain amount of money is advanced as a loan, in return for a greater amount of money to be received later, the magnitude of which is determined by a contractually agreed-upon interest rate.

2. Commercial (merchants’) capital — M → C → Mº. In its most simple form, this just involves the purchase of a commodity for a certain amount of money and its resale for a greater amount of money.

This can be accomplished in any number of ways. First, a merchant can simply find a chump who is willing to either sell a commodity for less than its value, or a chump who is willing to buy a commodity for greater than its value.

A more calculated approach might involve the purchase of a commodity in a locale where it is abundant (where it is not as highly valued), and then transport it for sale in a locale where the commodity is scarce (where it is more highly valued). The difference between the money originally paid and the money received at the end of this cycle is the surplus value.

3. Industrial capital — M → C → Mº. Formally, this circuit is identical with that of merchants’ capital. The crucial difference consists in the nature of the commodity purchased. In the movement of industrial capital, the commodity bought is always the labor-time of another person.

Thus, the formula for industrial capital may perhaps be more properly described as M → C(L) → Mº.

Obviously, in this formula the following symbolism is used:

L = Labor.

The labor-time expended by the worker imparts greater value onto the articles under production, thus augmenting the original value of the commodities involved.

Two methods can be used to extract surplus-value in this process:

1. Absolute surplus-value — The capitalist extends the length of the working day, so that the worker invests an amount of labor-time into production greater than the value he receives in wages. Once the commodities produced in this process are sold in circulation on the market, the surplus-value gained thereby is “realized.”

2. Relative surplus-value — The capitalist reduces the amount of time required to impart a certain amount of value into production below the average of the social aggregate. This is accomplished by either revolutionizing the social organization of the division of labor or by overhauling the technical means of production. As a result, the capitalist is able to sell the commodities produced at a level lower than the social average while still realizing the same amount of surplus-value.

Of course, once these new methods of heightened productivity are generalized throughout society, the advantage gained vanishes. This necessitates a constant revolutionization of the technologies and organization used in production, and an accelerating pace of modernization. This gives rise to what Moishe Postone has called the “treadmill effect” of capitalism.

4. Finance capital — Mx → M → C → Mº → Mºx. In this formula:

x = x/100, where x ≤ 100.

Finance capital operates by having investors contribute a percentage of the overall money used to supervalue the value originally inserted into the circuit. Typically, finance is invested into industry, where again the commodity purchased is labor. Thus, the formula in this instance would appear as Mx → M → C(L) → Mº → Mºx.

Corporation — A corporation is an association of capitalists who jointly share ownership of a single enterprise. This is achieved by making shares of the company’s ownership available for purchase by the public. Historically, this is connected to the rise of the join-stock exchange in the middle of the nineteenth century. While corporations tend to be much larger and more visible than smaller private businesses, both operate according to the logic of capital.

NEGATIVE DEFINITIONS

Now that we have indicated what these terms are, we can safely say what they are not, in order to clear up some common misconceptions surrounding them.

Commodity — A commodity is not identical to any other good, article, or product. Unlike these other products, commodities are not produced for immediate use or consumption by their producer. Rather, commodities are produced in order to be sold or exchanged, either for money or for other commodities.

Furthermore, commodities are not unique to capitalist society. Obviously, there existed precapitalist systems of barter, commerce, and exchange. The point is that throughout most of history the majority of products were not intended to serve as commodities. They were for the most part produced to serve the most immediate needs of the producer, or alienated without recompense into the possession of one’s feudal lord. By contrast, capitalism only comes into existence when the majority of products produced by society are commodities.

Currency/Money — The value of money is neither imaginary nor arbitrary. Money is simply the universal equivalent form of exchange, used as a measurement of the value of goods, or commodities. This is something of which the Alternative Currency working group should take note.

There are quite real and concrete historical reasons for the development of the money-form of value. Precious metals came to serve as this medium of exchange because of their practical divisibility, and because of their relative scarcity (and thus also their value, given the difficulty of their location/extraction). It is true that these metals come to be increasingly substituted by paper money representing their value, and even more abstract forms of credit, but this does nothing to diminish the validity or reality of money as an expression of value.

Capital/Capitalism — Capitalism does not necessarily entail the existence of a free market. The libertarian notion that has become fashionable in recent years is that only under the economic conditions of laissez-faire, or government non-intervention, can capitalism flourish and exist in a “pure” form. They cite Bernard Mandeville or a diluted, oversimplified version of Adam Smith as evidence of this proposition.

Some leftish moderates, accepting this facile rightist notion of what capitalism is, naïvely believe that administrative reform, government oversight, more expansive welfare/social programs, and bureaucratic regulations would help counter the volatility and rampant inequality inherent in capitalism. They believe that the perpetual crisis at the core of capitalism can be “curbed,” “corrected,” or even “controlled” by such Keynesian, neo-Fordist measures.

In reality, however, state-interventionist capitalism is just as capitalist as free market capitalism. The fundamental principle underlying capitalism in all its different configurations is perhaps elusively straightforward: capital itself.

Corporation — A corporation is not simply any form of capitalist big business. In fact, in terms of private property, a corporation is actually less tied to the interests of a single individual than non-corporate businesses. Because the existence of a corporation qua corporation involves an enterprise “going public,” i.e. selling shares of its ownership, it actually reflects (in terms of sheer magnitude) a larger proportion of the public interest than a smaller private enterprise.

Of course, the public character of the corporate enterprise and big agribusiness (the Monsantos of the world) shouldn’t fool us as to their capitalist nature. A corporation is beholden only to the interest of its shareholders, and not to the public at large. They have one obligation alone — to turn a profit for those who own a portion of their stock. And corporations have been known to be exceptionally ruthless in this pursuit.

The only point that I am trying to make by this is to note the irrevocably capitalist character of both big corporations as well as small businesses. Both operate according to the logic of capital: the supervaluation of value. In other words, big corporations and small businesses have the same goal at the end of the day. They seek to turn money into more money. Continue reading →

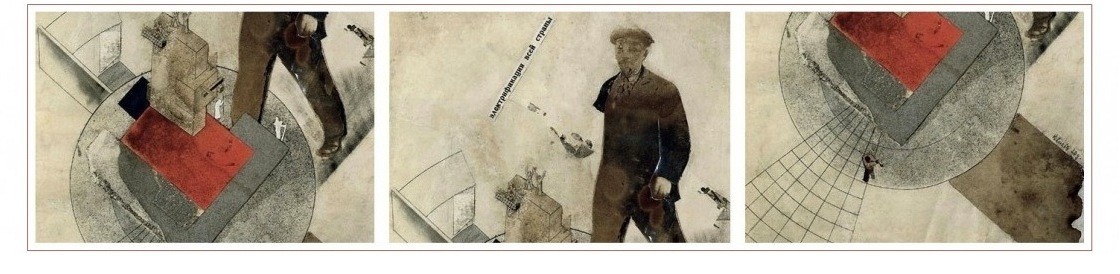

With lightning telegrams:

Like this:

Like Loading...